Scheduled depreciation allows you to automate asset depreciation based on standard accounting methods:

-

Straight Line: Spreads the depreciable base evenly across the selected period.

-

Double Declining Balance: Accelerates depreciation by applying a higher rate in the earlier periods of an asset’s life.

-

Half-Year: Applies a half-year of depreciation in the first and last year of the asset’s life, regardless of the acquisition or disposal date.

Understanding how different methods and timeframes affect depreciation is key. To help, we have provided practical examples showing how depreciation is calculated under various conditions.

You can add depreciation schedules in the Rollforward and Schedule tabs.

Add a depreciation schedule item

-

Open the Scheduled Depreciation task.

-

In the Schedule or Rollforward tab, click

to add a schedule item. The Add Item form opens with the Depreciation method field pre-filled. See examples of Depreciation methods.

to add a schedule item. The Add Item form opens with the Depreciation method field pre-filled. See examples of Depreciation methods. -

Enter the required details:

-

Name

-

Start and End Dates

-

Duration (calculated automatically from the dates)

-

Debited Account

-

Credited Account (pre-filled)

-

Starting Balance(the asset cost.)

-

Salvage Value (estimated worth of the item at the end of its useful life)

Note:The system automatically calculates:

-

Monthly depreciation amount

-

Accumulated depreciation

-

Distribution across the schedule period

-

Depreciable base (asset cost minus salvage value)

-

-

-

Optionally, adjust depreciation amounts if needed, to ensure that they equal the depreciation base.

-

Save the schedule item.

Depreciation methods

Depreciation methods or depreciation schedule types are different ways to calculate how an asset's value decreases over time.

Straight Line (SL) depreciation

In the application, the Straight Line (SL) method spreads depreciation evenly over the asset’s useful life. This means the same amount is recorded each period until the asset reaches its salvage value.

How the application handles SL:

-

The depreciation amount is calculated once, based on (Starting Balance – Salvage Value) ÷ Useful Life.

-

The system applies this fixed amount each period.

-

If an asset starts or ends in the middle of a month, the application uses proration to record only part of the depreciation for that period.

As with DDB, you do not need to calculate these amounts yourself. The system automatically applies the SL method — the examples are provided only to illustrate how results appear in schedules.

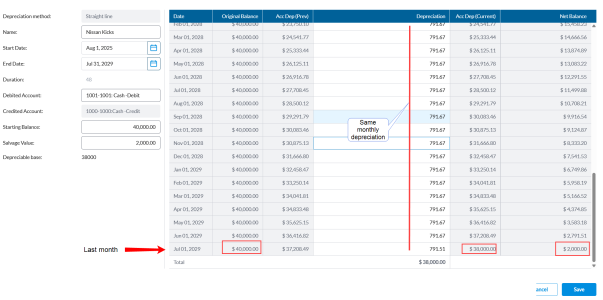

Straight line Depreciation using flat monthly rate

Asset Details

-

Starting balance: $40,000

-

Salvage value: $2,000

-

Useful life: 4 years (48 months) August 1, 2025 - July 31, 2029 (full first and last months)

-

Depreciable amount: $38,000

Calculation

Annual Depreciation = (Cost - Salvage Value) ÷ Useful life ($38000 (depreciable amount) ÷ 4 years = $9500 per year)

Monthly Depreciation Full month = $38,000 ÷ 48 months = $791.67 per month until the salvage value is reached.

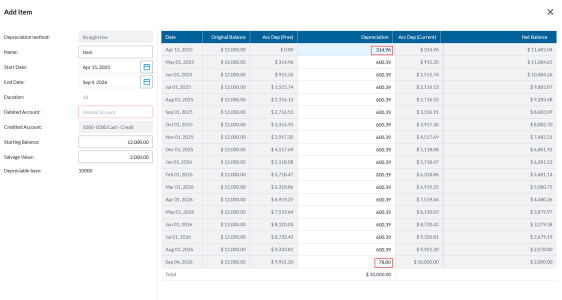

Straight line Depreciation with partial periods (Prorated)

- Starting balance: $12,000

-

Salvage Value: $2,000

-

Depreciable Base: $10,000

-

Start Date: April 15, 2025

-

End Date: September 4, 2026

Since the start and end dates fall within a month, depreciation is prorated by days for those partial months:

-

April 15–30, 2025 (16 days): $314.96

-

May 2025 – August 2026 (16 full months): $600.39 per month

-

September 1–4, 2026 (4 days): $77.52

-

Total depreciation = $10,000

Double Declining Balance (DDB) depreciation

The Double Declining Balance (DDB) method is used to calculate depreciation by applying a higher rate in the early periods of an asset’s life. This means the system records larger depreciation amounts at the start and smaller amounts later on.

How the application handles DDB:

-

Depreciation is recalculated each period based on the remaining book value of the asset.

-

The system automatically checks the amount against the Straight Line (SL) method.

-

If DDB becomes lower than Straight-Line, the system switches to SL so the asset is fully depreciated by the end of its useful life.

-

If an asset starts or ends in the middle of a month, the application applies proration so that only part of the depreciation is recorded for that period.

Note: You do not need to calculate these amounts manually. The system performs the calculations automatically — the examples below are provided to help you understand how results are generated.

The following examples show how the system applies DDB in different situations: prorated periods, full periods, and transitions to Straight-Line.

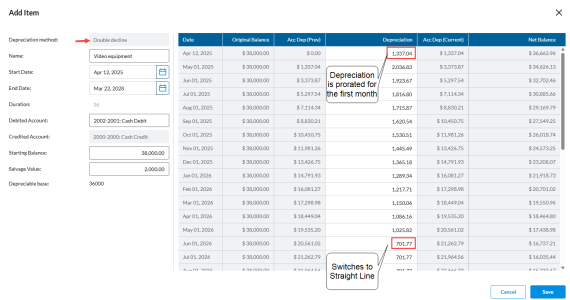

Pro Rated Periods (DDB to SL)

-

Starting balance: $38,000

-

Salvage Value: $2,000

-

Start Date: April 12, 2025

-

End Date: March 22, 2028

In this scenario, depreciation is prorated for the first month since the asset was purchased mid-month.

Note: The system automatically switches to Straight Line in June 2026, when DDB falls below the SL threshold. In this case, the monthly Straight Line depreciation is calculated as:(38,000 - 2000)÷ 36 = 1,000 per month.

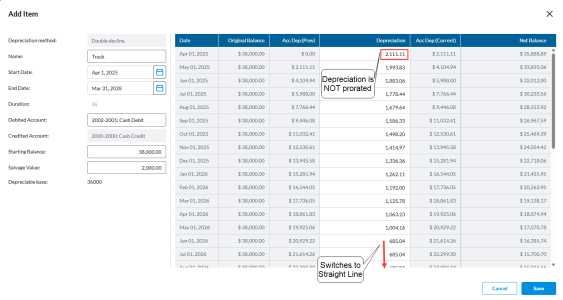

Full Periods (DDB to SL)

-

Starting balance: $38,000

-

Salvage Value: $2,000

-

Start Date: April 1, 2025

-

End Date: March 31, 2028

This example shows depreciation applied across full months (no proration).

Note: No prorated calculation is required since the start and end dates align with full periods. The SL calculation is triggered when the DDB falls below the SL threshold

Half-Year depreciation

The Half-Year method spreads depreciation by applying only half of the annual depreciation in the first and last year of an asset’s useful life. This creates a balanced approach, ensuring that assets purchased or disposed of during the year are fairly depreciated.

How the application handles Half-Year depreciation:

-

The first year records 50% of the annual depreciation.

-

Each full year after records the full annual depreciation amount.

-

The final year again applies 50% of the annual depreciation to complete the schedule.

Note: The system calculates this automatically. The examples provided in this section are for understanding how the values appear in depreciation schedules.

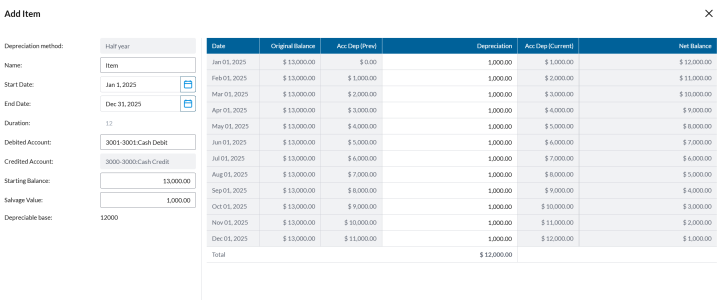

Half-Year depreciation Full Period (No Proration)

-

Starting balance: $13,000

-

Salvage Value: $1,000

-

Depreciable Base: $12,000

-

Useful Life: 12 months (1 year)

-

Start Date:Jan 1, 2025

-

End Date: Dec 31, 2025

-

Annual Depreciation = 12,000 ÷ 1 = 12,000

For this 12-month asset, Half-Year without proration behaves the same as Straight Line, since there is only one service year and the first and last months are not split.

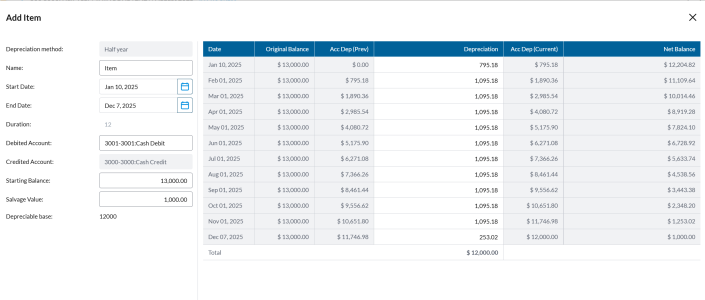

Half-Year depreciation with Proration

- Starting balance: $13,000

-

Salvage Value: $1,000

-

Depreciable Base: $12,000

-

Useful Life: 12 months (1 year)

-

Start Date: Jan 10, 2025 (partial month)

-

End Date: Dec 7, 2025 (partial month)

-

Annual Depreciation = 12,000 ÷ 1 = 12,000

In this Half-Year example with proration, the 12-month asset’s depreciation is prorated in the first and last months to reflect the actual number of days the asset was in use during those partial month.

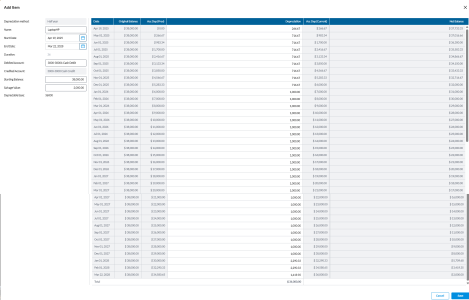

Half-Year depreciation with Proration (3 years)

-

Starting balance: $38,000

-

Salvage Value: $2000

-

Depreciable Base: $36,000

-

Useful Life: 36 months (3 years)

-

Start Date: April 19, 2025 (partial month)

-

End Date: March 22, 2028 (partial month)

-

Annual Depreciation = 36,000 ÷ 3 =12,000

-

First Month (Partial – April 2025):

-

Depreciation is prorated based on days in service.

-

Amount: $266.67

-

-

Remaining Months of First Year (May – Dec 2025):

-

Each full month records $716.67 depreciation.

-

Total for Year 1 (including April prorated): $6,000

-

-

Years 2 and 3 (Full Service Years):

-

Each year follows the half-year convention:

-

$12,000 ÷ 12 = $1,000 per month

-

-

So:

-

Year 2 (Jan–Dec 2026): $12,000 (1,000 × 12)

-

Year 3 (Jan–Dec 2027): $12,000 (1,000 × 12)

-

-

-

Final Year (Jan – Mar 2028, Partial Months):

-

Depreciation is prorated across the last months until end date.

-

Jan 2028: $2,290.33

-

Feb 2028: $2,290.33

-

Final Partial Month (March 2028): $1,419.35

-

Combined with prior years, accumulated depreciation reaches $36,000, reducing the balance to the $2,000 salvage value.

-

How depreciation is applied:

Depreciation methods - quick comparison

| Method | How it works in the application | Special handling |

|---|---|---|

| Straight Line (SL) |

Same depreciation amount each period, based on: |

Prorates first and last months if the asset does not cover a full period. |

| Double Declining Balance (DDB) | Accelerated depreciation: higher amounts at the start, smaller later. Switches to SL when DDB falls below SL. | System switches to SL automatically; prorates for partial months. |

| Half-Year | Records half of the annual depreciation in the first and last year; full depreciation in between. | Ensures fair allocation across first and last years. |

The system automatically applies each method based on the schedule you set up — users do not need to calculate values manually. Examples are provided to show how results will appear in depreciation schedules

View results

-

Schedule tab: Displays monthly distribution of depreciation from the start to end date.

-

Roll Forward view: Includes additional details such as salvage value, acquisition cost, accumulated depreciation, depreciation, and net balance