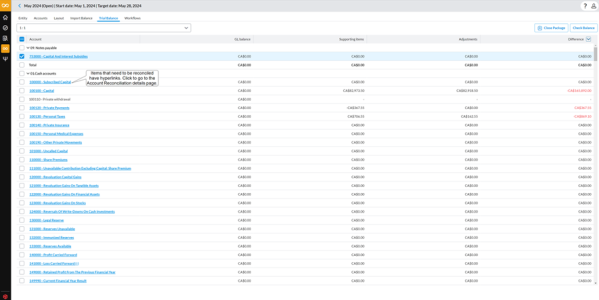

After importing the General Ledger Balance into the application, a trial balance sheet is automatically generated. This trial balance is organized using the business accounts that will appear on the financial statements. The accounts are listed in the order of their account numbers. Since most Charts of Accounts are structured according to balance sheet order, the unadjusted trial balance reflects this sequence as well, listing accounts in the following order: assets, liabilities, equity, income, and expenses.

Access the Trial Balance page

-

On the navigation menu, click

. The Period Setup page is displayed, showing the existing periods.

. The Period Setup page is displayed, showing the existing periods. -

Select a period.

The Close period details page displays the Entity page by default.

At the top of the Close period details page you will find the following information:

-

Period name and (Workflow Status): For example, August 2023 (Open)

-

Start date: For example, August 1, 2023

-

Target date: For example, August 30, 2023

-

-

Click the Trial Balance tab.

On the Trial Balance page, you can do the following:

View the trial balance of an entity

-

Click the Trial Balance tab. The accounts for the first entity in the Entity list are displayed.

Note: Hyper-linked accounts are those associated with Account Reconciliation workflow tasks. Clicking on the link navigates you to the Account Reconciliation details page for that specific account where you can start populating supporting items and adjustments. For Account Groups, the hyperlink is available only at the group level, not for individual accounts within the group.

-

From the Entity list, choose the entity to view its trial balance.

-

Optionally, click on a hyper-linked account to go to the Account Reconciliation details page and reconcile the account. For more information, refer to the Reconcile an account section of the Reconcile accounts article.

Generate journal entries

Clicking  generates a CSV file of journal entries that can be imported into your General Ledger (GL) system.

generates a CSV file of journal entries that can be imported into your General Ledger (GL) system.

To generate a monthly journal entry output file, ensure that both the Debited Account (typically an expense account) and the Credited Account (typically a prepaid asset account) fields are completed in the schedule item.

Journal entries will only be generated if the schedule includes both of the following columns:

-

A Debited Account column

-

A Credited Account column